HBFI continues to provide strong level of funding for viable developments throughout Ireland.

Funding to date

Total loan approvals to the end of December 2025 were €3,323bn. This funding is across 233 projects and can support the delivery of 16,558 homes. Of the 233 projects with funding approved, 152 projects are now under construction or completed. These projects will support the delivery of 13,246 new homes.

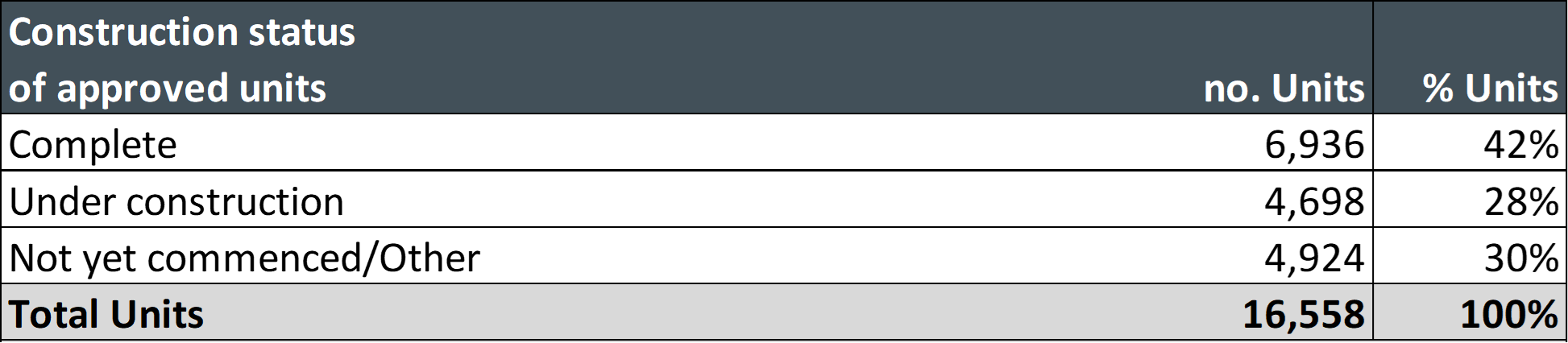

Construction Status

As of 31 December 2025, 6,936 of the units within these 152 schemes were completed with a further 4,698 under construction.

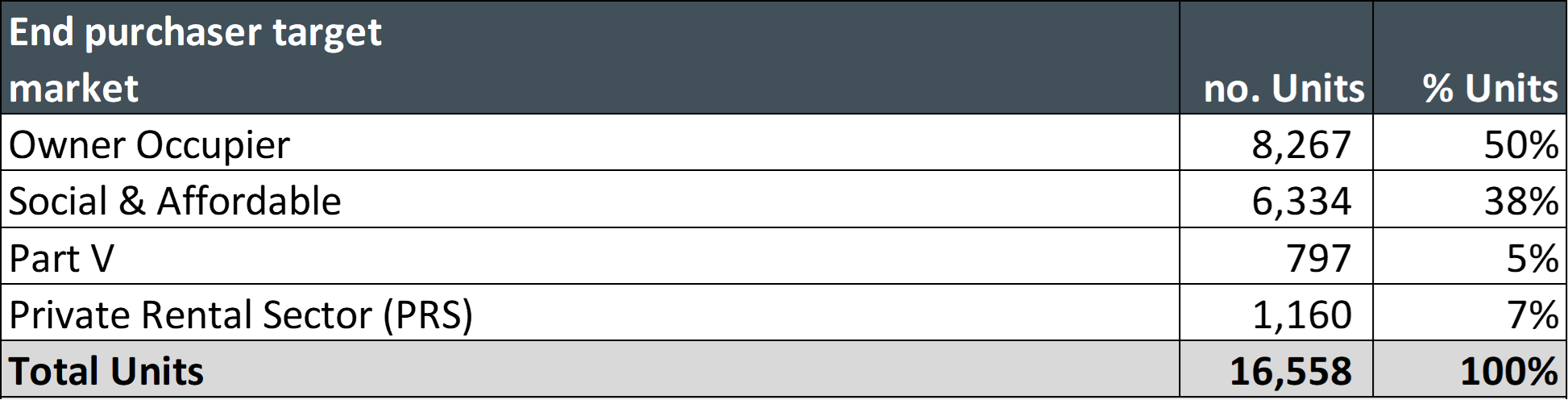

Target Markets

To date 8,267 of HBFI-funded homes are for owner-occupiers, 6,334 for social/affordable housing, 797 Part V and 1,160 for renters.

Locations

HBFI has approved 233 facilities as of the end of December 2025. These facilities are in various locations across 25 counties with an average of 71 new homes per facility. HBFI remains focused on supporting viable developments across the whole of Republic of Ireland. 66% of total units approved to date are for areas outside of Dublin.

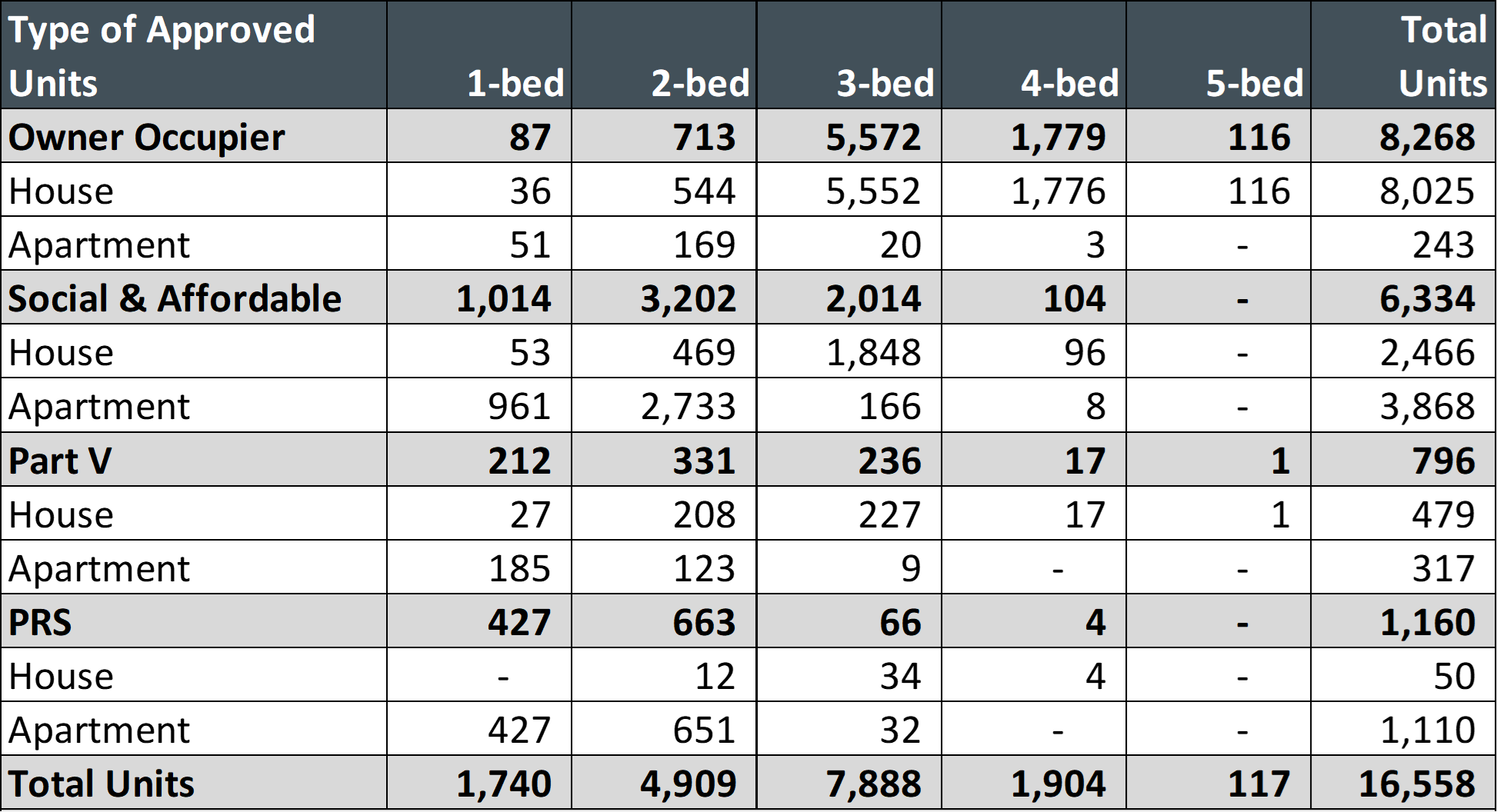

Unit Types

To date 88% of homes funded by HBFI consist of 3 bed or less with a further 11% being 4 bed units. 67% of all units are houses with the remaining 33% being apartments.

Development Sizes

HBFI is committed to supporting all types of developments across Ireland. The majority of the 233 approved developments funded by HBFI are small to medium sized schemes with 67% of the approved developments being <50 units with an average of 21 units. In value terms the larger schemes account for a greater proportion of total funding approved.

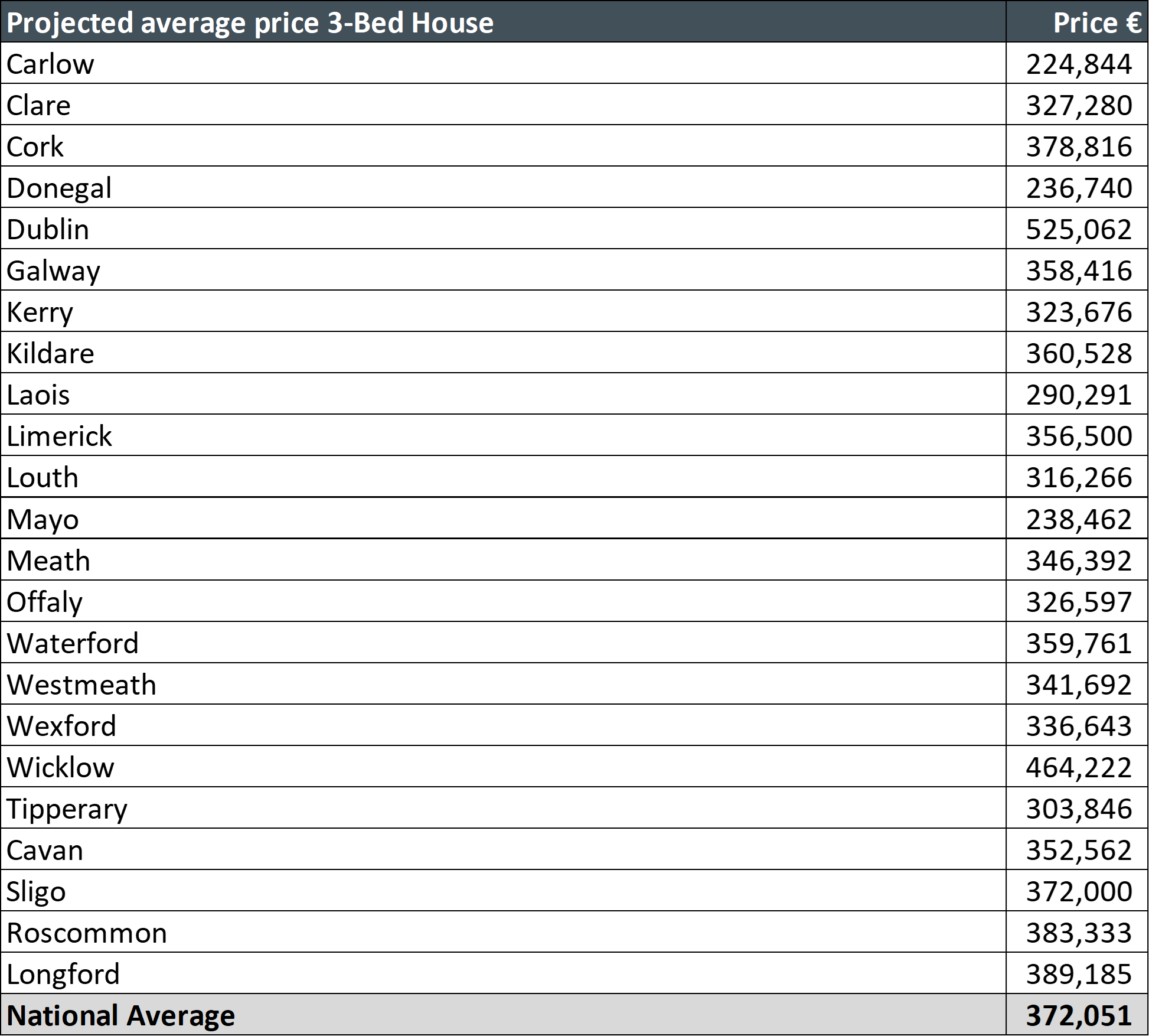

Average Prices

Below is the average forecasted price of a standard 3 bed house within the developments HBFI have approved funding for. The actual price will depend on when the units are completed and brought to market.

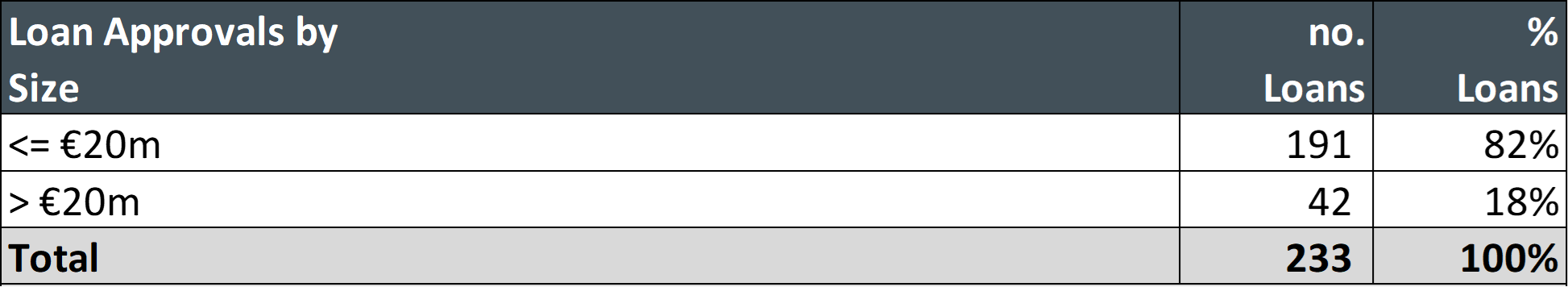

Approvals by Size

To date 82% of all HBFI loan approvals have been for €20m or less.

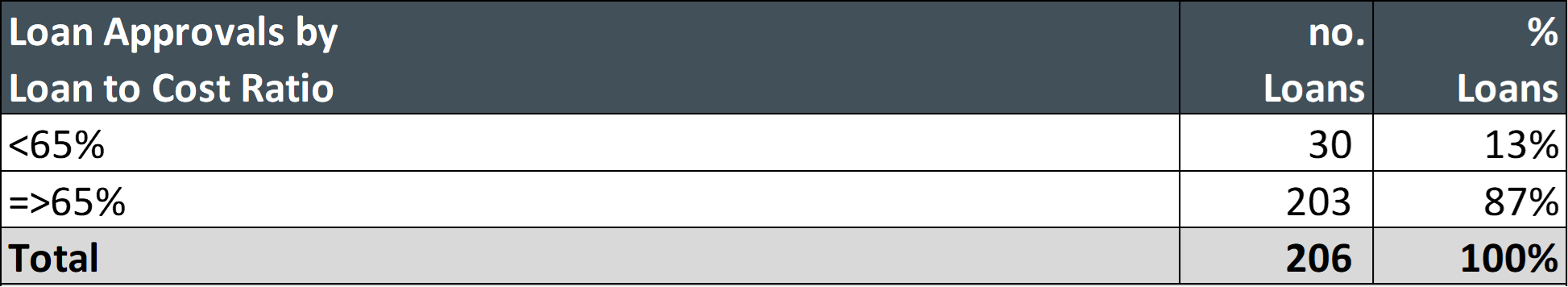

Approvals by Loan to Cost Category

87% of all approvals to date have a loan to cost ratio equal or greater than 65%.

This information is also available to download below.